Tax deductible donations, an EOFY Guide

The end of financial year is a great time to boost your tax deductible donations. Donors can potentially reduce their taxable income, and charities benefit. But how do tax deductible donations work? And how do you know if a donation is tax deductible?

Are donations tax deductible in Australia?

The short answer is yes, it’s easy to find out what donations are tax deductible. First, find out if the organization you are donating to is endorsed as a Deductible Gift Recipient (DGR). You can do this easily by checking the ACNC Charity Register. If you did not receive any gain from the donation, then you should be able to claim the tax benefit.

How do tax deductible donations work?

In order to claim donations as tax deductible, you’ll need to provide proof of your donation. If your workplace uses the Good2Give Giving Platform, your donations will automatically appear on your group certificate. If you’re not on the Good2Give Platform, you’ll need to keep every receipt of every donation and record them as part of your tax return. When you donate through our workplace Giving Platform, your donation is deducted by your employer directly from your pre-tax pay. That means no receipts from charities are needed. There is also no need to file donations separately as your tax deductions with the Australian Tax Office come July.

When your donation is made directly from your salary before tax, you are giving more money than you would have otherwise given after been taxed. This means more funds will go directly to your chosen charities, all with minimum effort from you!

What donations are tax deductible?

What donations are tax deductible?

So what can you claim? Once you’ve established the charity has DGR status, you then need to assess what has been donated using government guidelines. Your donation must have been a genuine gift, meaning you received nothing in return. For example, a monetary donation is eligible, but the purchase of raffle tickets or fundraising items is not. Financial assets such as shares can be eligible too. If you’re donating through our workplace giving platform, your donations direct from your salary will be logged as pre-tax donation, and you should be able to enter any donation made elsewhere for post-tax matching and recording.

Charitable donations and taxes

Why are charitable gifts and donations important?

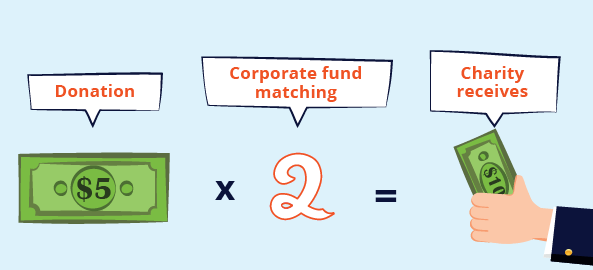

Charitable donations represent half of all charity sector revenue. The financial support provided by donors plays a vital role in keeping charities operating. The easiest, and most beneficial way of donating is direct from your pre-tax salary. Depending on your tax bracket, if your donation is between $55 – $68 it becomes $100 for your charity. With Government forfeiting any tax on the charitable dollar means your goodwill goes further. If then matched by your employer through workplace giving, your donation can quickly mean $200 for your charity at only $70 to you.

How much do charitable donations reduce taxes?

A tax-deductible gift or donation to charity can reduce your taxable income. That means you will receive a higher refund on tax paid throughout the year. Any deduction is directly relevant to your donation amount and your taxable income bracket. Workplace giving solutions such as Good2Give’s Workplace Giving Platform make it easy to set up regular donations throughout the year, and one-off donations. When you donate through the Platform, the tax benefit on your income is immediate. You can also monitor your giving and work out if an additional one-off donation makes financial sense.

EOFY donations and taxes

Why donating BEFORE EOFY is a good idea

There’s a reason why the end of financial year is one of the most popular times to donate to charity – it makes great financial sense. If you’re on the brink of your tax bracket, you may reduce your taxable income enough to bring your tax bracket down. With our Workplace Giving Tax Calculator you can easily see how much a regular donation from each pay, or a one-time donation, will save you in tax. It will also show you how much more the charity receives when the funds come to them directly from your salary.

5 top tips for EOFY donations

- Check the charity status – only donations to DGR registered charities are eligible

- Donate directly from your salary – no receipts needed and no administration hassle

- Always get a receipt if you donate elsewhere

- Check your tax bracket, a larger donation could reduce your taxable income

- Pre-tax donations direct from your pay mean more money for the charity